{Wouldn’t or not it's pleasant to invest in a gradual, trusted useful resource? Gold cannot be overproduced or copyright. On top of that, in case conventional stocks plummet in worth speedier than investors can promote them, the gold bullion selling price historically rises. This is because following a marketplace crash, investors thrust their currency into precious metal assets rather. When this occurs, this ‘gold bull operate cycle’ historically has actually been liable for unparalleled monetary ROI for investors.

It addresses a number of pitfalls by providing possibly a Loss of life benefit or possibly a source of cash flow. As well as, you can get tax deferral within the growth of your respective investment.

Diverse investment options: As opposed to an average organization-administered retirement plan, these plans might permit you to invest in a wider assortment of assets.

It might acquire nearly 30 calendar days for variations to the Most well-liked Rewards position or tier for being affiliated with and helpful in your accounts within the advisory applications. This cost is charged regular beforehand. Besides the annual plan cost, the costs of the investments will vary dependant on the particular funds inside each portfolio. Precise fund bills will differ; make sure you check with Just about every fund's prospectus.

Investing in securities includes risks, and there is often the potential of dropping dollars once you put money into securities.

Without click here to find out more a Basis to adhere to, an unexpected expenditure or unforeseen decline could have to have dipping into extended-term investments to protect quick-phrase needs.

As with all defined contribution plans, there’s generally uncertainty about what your account stability is likely to be if you retire.

If you’re lucky to be aware of you have revenue or assets that you don’t have to have, gifting it As you’re alive might help from the tax standpoint.

Any person, in spite of cash flow, can open and fund a conventional IRA. There are actually money thresholds that reduce larger-earners from directly contributing to your Roth IRA, although they Click This Link will still obtain the main advantages of a Roth account via a backdoor Roth IRA.

Constantly know where you stand with a personalized see of what's relevant to your portfolio now — your functionality, your holdings, the market plus more.

Within a brokerage account, the cash gains you know after you market in a gain and dividends attained by your investments are taxable based upon your recent money stages.

A Roth IRA is a wonderful option for its huge tax benefits, and it’s an excellent selection in the event you’re capable of expand your earnings for retirement and continue to keep the taxman from touching it once again.

To place a trade, you'll need to log in. From there, you'll be able to choose the Trade tab from the navigation menu then select the sort of investment you need to trade. Or, if you already know the image from the investment you would like to trade, you can enter it while in the look for bar in the best ideal and select the Trade button that seems.

three. Speak to your 401(k) plan administrator and ask for a immediate rollover for your new check over here IRA account. Your new IRA administrator might be able to initiate this method in your case.

Jonathan Taylor Thomas Then & Now!

Jonathan Taylor Thomas Then & Now! Anthony Michael Hall Then & Now!

Anthony Michael Hall Then & Now! Sydney Simpson Then & Now!

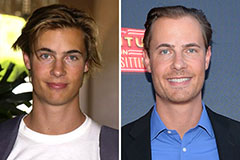

Sydney Simpson Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Macaulay Culkin Then & Now!

Macaulay Culkin Then & Now!